Financing ambitious climate action: financial mechanisms explained

Financial ambition is among the “ambition criteria” of the NAMA Facility, future Mitigation Action Facility, when it selects climate change mitigation projects that help implement a country’s Nationally Appropriate Mitigation Action (NAMA) to meet Paris Agreement goals via NAMA Support Projects (NSPs) to receive funding. A crucial evaluation criterion for projects is their transformational change potential. The design of viable financing mechanisms ensures both implementation readiness and transformation potential of projects. The NAMA Facility defines a financial mechanism as “an adequate financing mechanism [which] is at the core of a NAMA Support Project (NSP). [It] needs to be defined in a way to incentivise a behavioural change of market participants (consumers, investors) towards a carbon-neutral pathway. At the same time, it should ensure the most efficient use of NAMA Facility grants as it leverages public and/or private funds.”

Why are financial mechanisms needed to drive climate action projects?

Financial mechanisms paired with regulatory changes can ensure the sustainable reduction or removal of market barriers that would otherwise enable large-scale and lasting solutions to carbon-neutral development. Furthermore, financial mechanisms can help achieve financial viability in the business model of a climate mitigation project, thus accelerating the adoption of similar projects and assuring the sustainable transformation of the targeted sector.

What approaches and tools constitute the financial mechanism?

A variety of financial mechanisms exist to address different market barriers such as risk perception and limited market liquidity, among others.

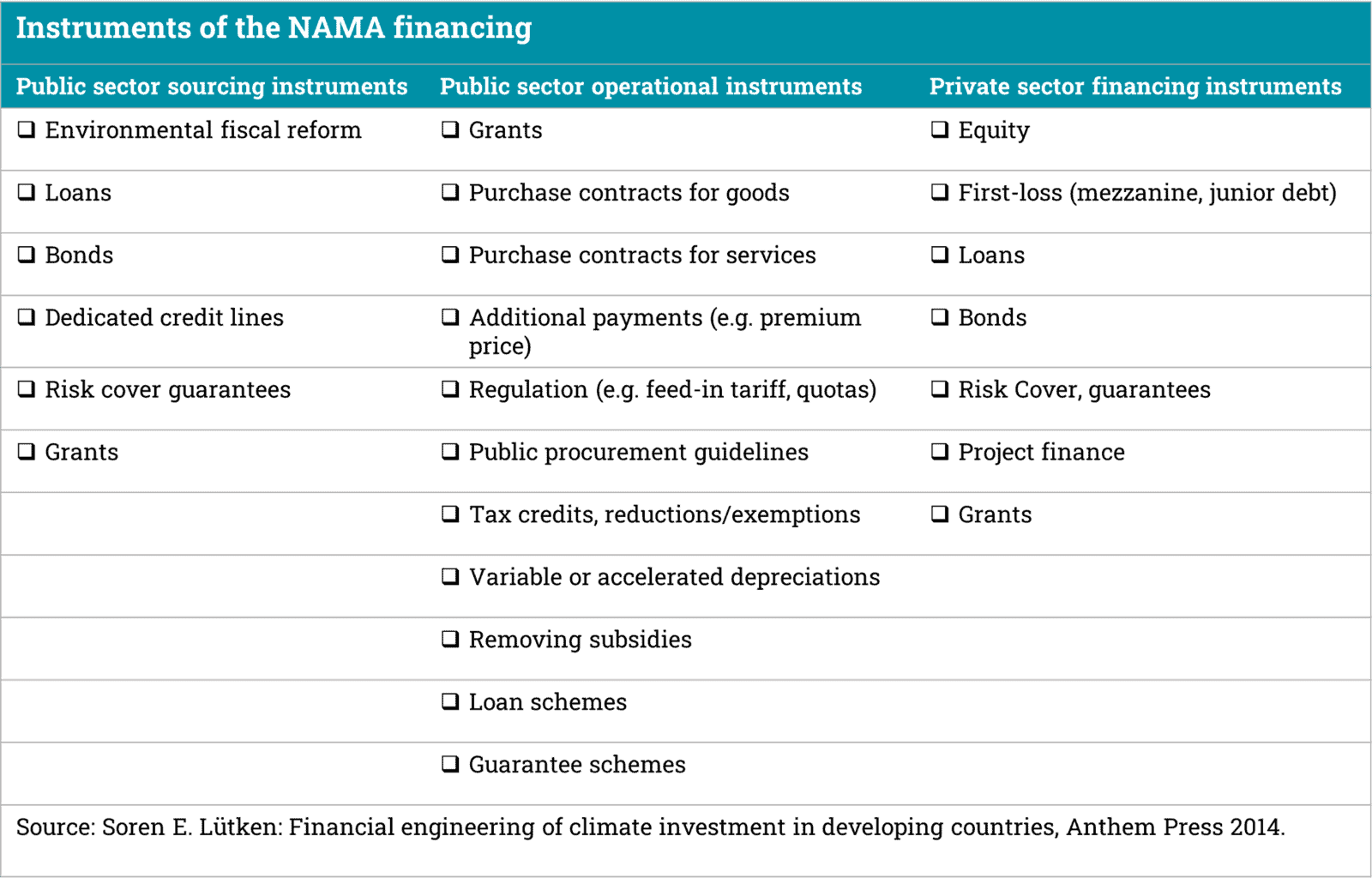

The following are a mere selection of approaches or tools: 1) concessional loans and loan guarantees for financial intermediaries; 2) small-scale direct investment subsidies / grants to private sector investors; 3) Grant funding of public infrastructure; and 4) results-based financing for private sector. The below table lists public sector sourcing instruments vs operational instruments and private sector financing instruments. A sourcing instrument is used to acquire the funds that will be later used to finance the NAMA, or mitigation measure, and can be local or international. An operational instrument is used to employ funds that have been acquired already. They are local by nature, and the funds will be used by the NAMA.

What challenges are seen with financial mechanisms within the NAMA Facility portfolio and open Calls for projects?

As of June 2022, the NAMA Facility received 476 NSP Outlines until this most recent Call, the Ambition Initiative – Round Two, a Call for Projects with unique features and focused on ambitious climate action and a green recovery. In many cases, the description of the proposed financing mechanisms required further development during the detailed preparation phase (DPP) and adjustment in the projects’ Implementation Phase.

How does one determine the implementation readiness of a financial mechanism?

Implementation readiness of the financial mechanism is closely linked to the: 1) analysis/provision of business models for the typical investment(s); 2) reasoning for the selection and description of a particular mechanism; 3) institutional arrangements; and 4) a reasonable phase-out concept. Business models for typical investments are important because they can determine if a NSP has a chance for economic success and sustainability. They can provide a foundation for the design and selection of a financial mechanism. The key question is how an appropriate or balanced incentive can be provided so that beneficiaries will take up the offer. At the same time, the incentive ought to be used efficiently without creating market distortions.

How does one decide on an appropriate financial mechanism?

Deciding on the appropriate financing mechanism requires the proper identification of any financial/economic determinants of a particular investment, for instance, the life span and the pay-back period under market conditions and the cost of alternatives. Therefore, a sound analysis of the business model is crucial for setting up financial mechanisms. The design of an appropriate financing mechanism should be based on a business model and on a brief analysis of the specific (financial) market.

For example, the risk of investments for energy efficiency is rather with the investor than with the financier. The risk for the financier only arises if the overall energy efficiency investment puts the economic/ financial stability of the investor at risk. In this case, it would be more reasonable to cover the investor’s risk, for example, by an insurance scheme in order to allow for the investment in technologies with uncertain results. A subsidised interest rate could reduce the financing cost for an investor and make the investment on a certain mitigation technology feasible. A subsidised interest rate for certain investments could employ various possible instruments, such as straight interest subsidies or mixing of concessional and non-concessional financing. The cost of investment can also be reduced through other mechanisms such as tax and tariff exemptions.

It is important to justify the selection of the financing mechanisms on the background of the business model and the respective market conditions and barriers. In addition, financing mechanisms should be selected in a way that will maximise the use of the grant element by generating high leverage rates.

Are there examples of NAMA Support Projects with effective financial mechanisms?

The Thailand RAC NAMA Support Project provided financial assistance through the RAC NAMA Fund, a fund created to provide concessional loans and grants for the establishment of production capacities of green cooling technologies among Thai manufacturers. With a total budget of EUR 8.3 million, this NSP was able to leverage almost EUR 143 million in investments from the participating producers, financial institutions and end users of cooling equipment. From the returns of the revolving mechanisms of the RAC NAMA Fund, a spin-off Fund, the Cooling Innovation Fund (CIF), was created by the Electricity Generation Agency of Thailand (EGAT) who managed the RAC NAMA Fund. The CIF shares the goals with the original RAC NAMA Fund – a market transformation towards green cooling technologies using natural refrigerants. The scope and instruments will be extended to reflect the current stage of market development, advanced by the NSP.

Read more about the financial mechanism in this recently updated factsheet.

The NAMA Facility is a joint initiative of the German Federal Ministry for Economic Affairs and Climate Action (BMWK), UK’s Department for Business, Energy and Industrial Strategy (BEIS), the Danish Ministry of Climate, Energy and Utilities (KEFM), the Danish Ministry of Foreign Affairs (MFA), the European Union and the Children’s Investment Fund Foundation (CIFF).